Corporate Performance

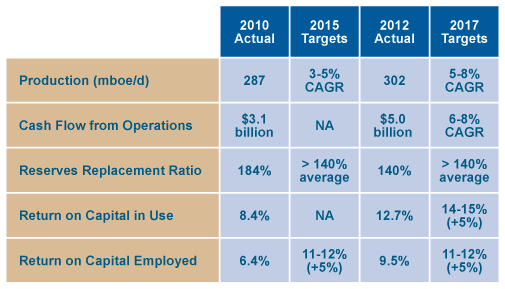

Husky has established clear financial and operational targets to deliver consistent value to shareholders and execute its balanced growth strategy, including production growth, increased net earnings and cash flow and improved return on capital.

Based on a strong balance sheet and a steady flow of near-term development projects, Husky set out new performance targets in 2012 for the coming five-year term.

-

These include:

- A five-year compound annual production growth rate (CAGR) target of five to eight percent through to 2017

- An increase of Return on Capital in Use (ROCU) to 14 to 15 percent

- Cash flow target of six to eight percent compound annual growth

The Company’s financial strategy ensures it generates sufficient operating cash to fund its capital plan and a sustainable dividend to achieve its balanced growth strategy.

The focused integration of the Upstream and Downstream assets contributed to the delivery of strong results in 2012 by helping capture near-Brent pricing for Heavy Oil and Western Canada production.

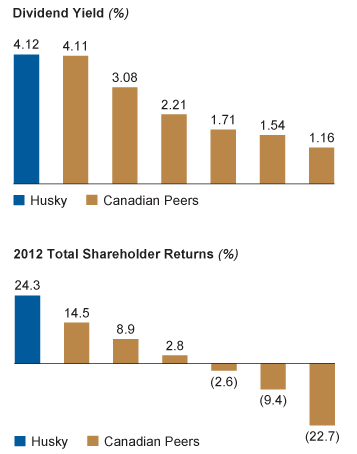

In 2012, Husky offered one of the strongest dividend yields among its Canadian peers and led its peer group in terms of total shareholder return.

The Company remains on course and is building momentum for the next stage of its growth.

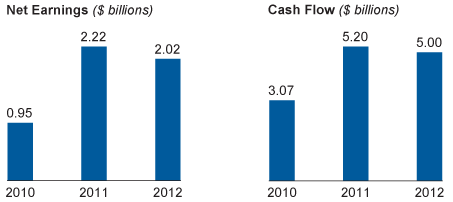

Net Earnings and Cash Flow

Net earnings in 2012 were approximately $2.0 billion, excluding after-tax gains on the sale of non-core assets. Cash flow from operations for the year was $5.0 billion.

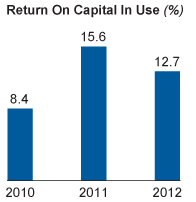

Return on Capital in Use

Return on capital in use (ROCU) is a measure used by the Company to better gauge the productivity of capital in projects currently in production. This helps balance short and longer-term developments to maximize value.

ROCU increased to approximately 12.7 percent in 2012, up from 8.4 percent in 2010 and in line with the company’s targeted increase to 14 to 15 percent by 2017.

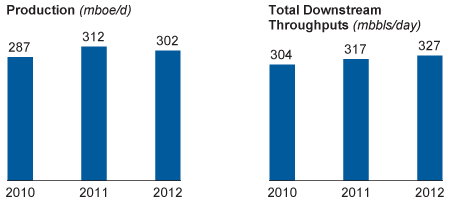

Production and Throughputs

Production was 301,500 barrels of oil equivalent per day in 2012, within annual guidance and in line with the Company’s plan to grow production five to eight percent on a compound annual basis through 2017.

Production totals reflected an earlier than anticipated startup of two heavy oil thermal projects, as well as two Atlantic Region maintenance offstations and a deliberate reduction in natural gas volumes.

Throughput at the Company’s refineries and upgrader averaged 327,000 bbls/day, up from 317,000 bbls/day in 2011.

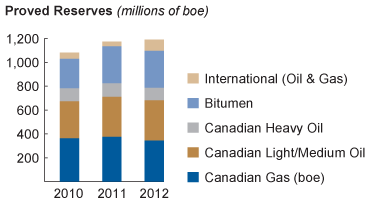

Reserves Replacement

Reserves growth has consistently outpaced production, with an average two-year proved reserves replacement ratio in 2011-2012 of 175 percent. Including economic revisions, the average two-year proved reserves replacement ratio was 149 percent, ahead of the Company’s five-year average target rate of 140 percent per year.

Reserves growth during the year reflected improved recovery and expansion of heavy oil thermal projects, additional drilling at the liquids-rich gas Ansell project, and initial booking of reserves for the deepwater Liwan Gas Project in the Asia Pacific Region.

At the end of 2012, Husky had total proved reserves before royalties of 1.2 billion boe, probable reserves of 1.7 billion boe and best estimate contingent resources of 13.1 billion boe. The Oil Sands portfolio was responsible for 11.6 billion boe of the best estimate contingent resources total.