2000s Diversifying the Business

Husky entered the 21st century optimistic and ready to pursue initiatives for growth. The acquisition of Renaissance Energy Inc., created the ‘new’ company, Husky Energy Inc. The Company secured a listing on the Toronto Stock Exchange and immediately became the second largest producer of oil and natural gas and the fourth largest downstream retailer in Canada.

The Company’s relationship with CNOOC grew and it signed an agreement to develop the Wenchang oil field in China. Within a few years it would joint venture with CNOOC for the Madura BD gas field offshore Indonesia.

Several strategic decisions were made and Husky explored opportunities to grow. It started oil production at Terra Nova, which was soon followed by first oil production at the White Rose oil field and development of the North Amethyst project offshore Newfoundland and Labrador.

The Company purchased Marathon Canada Limited and Marathon’s heavy oil assets in the fall of 2003. This allowed Husky to apply thermal and horizontal well technology.

Husky re-entered the U.S. refining business in 2007 with the purchase of the Lima Refinery, in Lima, Ohio, and became a 50/50 partner with BP in the Toledo Refinery, also located in Ohio. The Husky/BP agreement also included a 50/50 joint partnership in the Sunrise asset located in the Athabasca oil sands in northeast Alberta.

A global recession in 2008 caused volatility in commodity prices and economic uncertainty in the financial markets. The Company focused on strong financial discipline, spending on only those areas offering the highest returns and long-term growth.

SeaRose FPSO

SeaRose FPSO

Wenchang

Wenchang

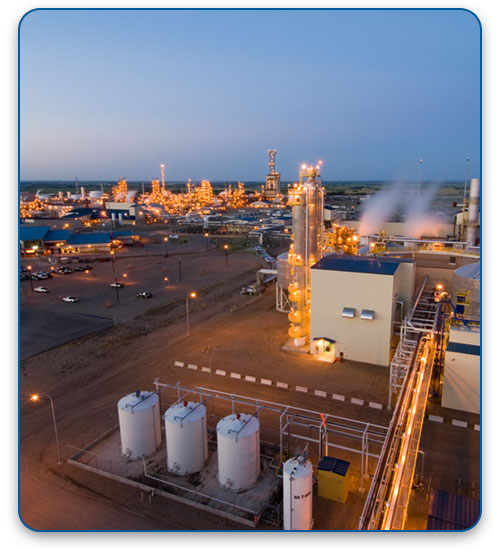

Lloydminster Ethanol Plant

Lloydminster Ethanol Plant

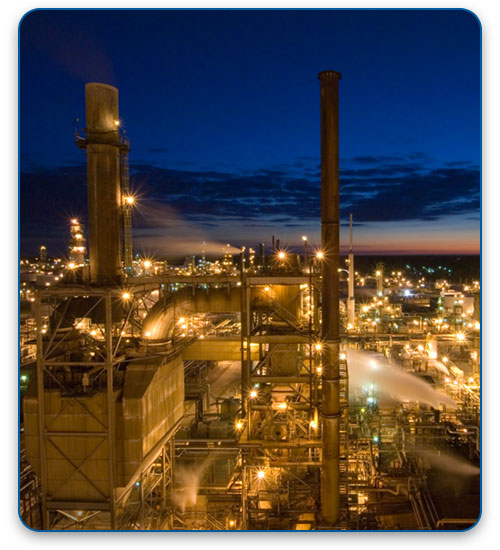

Lima Refinery

Lima Refinery

West Hercules

West Hercules