Corporate Performance

Liwan Gas Project

Corporate Performance

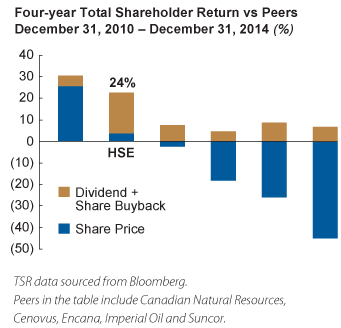

Husky has consistently delivered value to shareholders, through a strong dividend and by managing its investment flows and maintaining a healthy balance sheet.

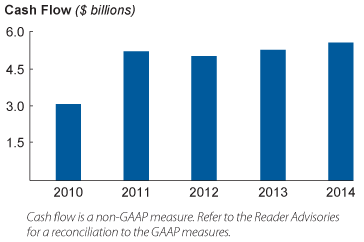

Net Earnings and Cash Flow

Net operating earnings in 2014 were $2.0 billion, comparable to 2013. Net earnings were $1.3 billion, including one-time charges. Cash flow from operations for the year was $5.5 billion.

Production and Throughputs

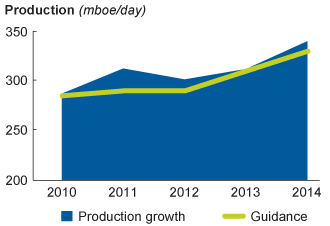

Production in 2014 was 340,000 barrels of oil equivalent per day, within annual guidance and an increase of approximately nine percent from the year before.

Throughput at the Company’s refineries and upgrader averaged 318,000 barrels per day.

Reserves Replacement

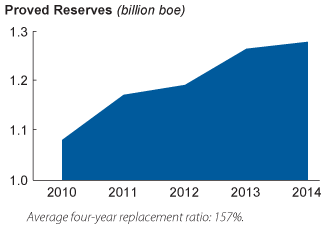

Husky’s reserves growth continued to outpace production in 2014 with a reserve replacement ratio of 115 percent in 2014, excluding economic factors (111 percent including economic factors). Its average four-year reserve replacement ratio was 157 percent, excluding economic factors, and 143 percent including economic factors.

At the end of 2014, Husky had total proved reserves before royalties of 1.3 billion barrels of oil equivalent (boe) and probable reserves of 1.9 billion boe.